Navigating the day-to-day using only cash is costly. While it provides emotional security—it can be stolen or prioritized in the wrong ways. For the two billion unbanked people in the world, simple transactions, such as sending cash to a family member, saving money, or even keeping it safe, are riddled with obstacles and fear.

Mobile money has the power to democratize subsidies, benefits, and information; it brings people from the margins into the formal economy, where they can be better served; and it can be a vehicle out of poverty. However, if digital financial technology scales without including vulnerable populations, income disparities will only grow more pronounced.

In Bangladesh, only around 15% of the population has access to formal banking services. In 2011, bKash launched a mobile finance tool to reach the unbanked. It amassed millions of users over the years, and in 2017, bKash partnered with IDEO.org to co-design their first smartphone app.

The goal was to engage a wide range of customers, including users who have low levels of literacy and limited smartphone experience. This new financial experience needed not only to include and be intuitive to people across spectrums of literacy and digital know-how.

This smart phone app has been downloaded by over 10 million users who manage their finances through subtle cues and thoughtful interactions. But behind each effortless swipe, there are principles-turned-features that build the trust needed to boost users’ confidence.

Finding sophistication in simplicity

While interviewing potential users, we found that even though digital savviness was generally low, the ability to learn quickly was high—and the real barrier of entry for people was the fear of failure or pride in figuring it out on their own. Clarity and straightforwardness go a long way in lowering the barrier of entry for users.

“I can’t use [apps] because I have a bad memory and I won’t remember how to do it.”

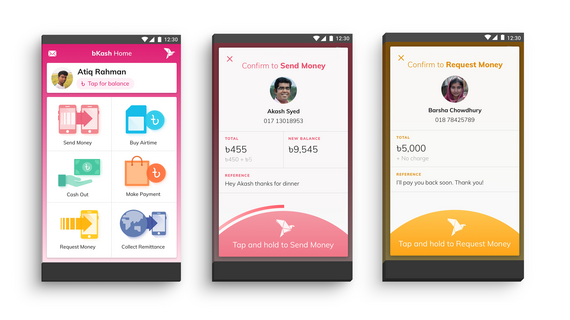

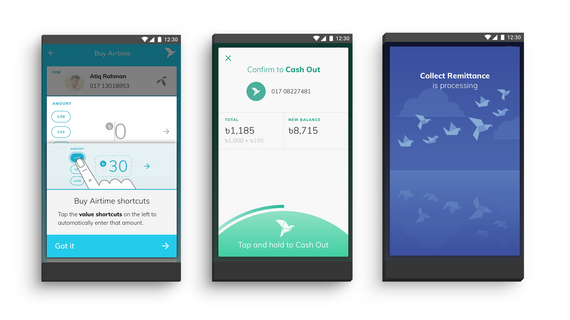

In the app, each service—exchanging money, buying airtime, cashing out—has an icon and each icon has a corresponding color to orient users and reinforce clarity at every step of the way. In fact, users can navigate the app with that iconography alone. These simple, less abstracted illustrations communicate meaning to the illiterate adults who make up about a third of the user base and double as guideposts for those with varying levels of English or Bengali fluency.

Anticipating actions

From low-literacy users who might be downloading an app for the first time to tech-savvy youth into the latest thing, we learned the convenience trumps concerns over privacy or risk of getting hacked. One of the goals with the app was to understand the users needs and anticipate them.

“Banks are more secure, but I don’t want to cause my mom extra hardship. Going to the bank is troublesome for me as well. Is mobile money safe? Even the government can get hacked.

Meanwhile all other functions lend clarity and ease to the process. We learned that while the young and tech-savvy are more receptive to new products, when it comes to mobile money, practicality primes. We anticipated possible roadblocks and designed to make the interaction as frictionless as possible: a back button ensures customers never have to start their transaction over; a QR code reader automatically inputs the merchant number, minimizing errors; and buttons surface the most commonly used transaction amounts and contacts, allowing users to move on without typing.

Being selective about moments of delight

In order to safeguard convenience and ease, moments of delight were chosen carefully. The design experience doesn’t draw much attention to itself. There are no frills to trip over, the goal was for users to glide through easy, effortless loops of activity.

“I don’t care about the emoji usage… but the calendar reminder I would use all the time!”

Instead of baking surprise-and-delight into the design, we peppered and reserved it for more impactful moments. For example, at the final moment of a transaction, users have to tap and hold. This differentiated interaction adds intentionality—and delight—to a key step, the transfer of money.

Building trust (and literacy) in time

While low barriers to entry and high interest rates promote a strong savings culture in Bangladesh, people have few methods for saving with specific goals in mind. Beyond the transactional appeal of the app, there’s a more aspirational element to its design that enables users to understand their habits and set goals.

“I run a clothing boutique and use bKash to pay my suppliers and get money from customers. …I do all my bookkeeping by hand in my diary. There’s a lot to track with a small business.”

Daily, weekly, and monthly summaries give users a birds-eye view of their finances and encourage long-term planning. As users accrue transactions over time, they can better understand their own spending habits and strengthen their financial literacy through tools, tips, and advice.

Launched in May 2018, bKash’s smartphone app is now in the hands of millions, showcasing the impact that technology can play in making digital financial services more accessible and inclusive.